Attempting to Transfer Cash From My Checking Account to a Crypto Exchange Only Increased My Dislike of Banks, and Reinforced My Support For Cryptocurrencies Like Bitcoin

Your Money Is Yours To Do With As You Please, As Long as You Keep It With Us

Consumer banking workflows appear to be designed to hoard as much client money as possible within a single institution, and to prevent consumers from moving their money elsewhere. I can instantly transfer as much cash as I want between affiliated institutions, such as between Bank of America and Merrill Lynch, or between TD Bank and TD Ameritrade.

As soon as I want to transfer cash to an unaffiliated institution, however, there are suddenly all sorts of transaction limits, identity verification requirements, verification windows, and fraud protection policies that prevent me from moving my money as I see fit.

For example, I’ve been a TD Bank customer for years, and I’ve had no problems moving tens of thousands of dollars from my TD Bank accounts to my TD Ameritrade accounts. I was even able to destructively close multiple TD Ameritrade accounts and merge them into a single consolidated account with a single click on their website.

But, as soon as I initiated a $5,000 USD ACH transfer from TD Bank to the Crypto.com exchange, my identity was suddenly in question, I had to call customer support to verify my identity, and my transfer had to be approved manually.

Even after jumping through the identity-verification hoops, I was told that it could take a multiple days for my transfer to be approved, so it might be a week before my funds appeared on the crypto exchange. Additionally, my ACH transfers were restricted to $2,500 USD per day, and $5,000 USD total per month.

When I inquired about immediately increasing my ACH transfer limits, I was told that it would take a minimum of six months to be approved for an ACH increase, even though I’d been a customer in good standing for years.

It’s Expensive to Not Be Rich

The ACH network recently increased their same-day transfer dollar limit from $25,000 USD to $100,000 USD, but consumer banks still limit their customers’ ability to transfer funds to a fraction of that limit. My $5,000 USD per month limit is generous; most TD Bank accounts have a limit of $3,000 USD per month.

I understand that wire transfers exist to move larger sums of cash, but wire transfers are expensive. A TD Bank wire transfer costs $30 USD. So, if I’m wire transferring $5,000 USD to a retirement account or a crypto exchange to bypass the ACH limit, then I’m already getting hit with over a half-percent loss on my investment just to move the funds. And that’s before any exchange fees or commissions.

Compare that to transferring Bitcoin — in January it cost a little under a dollar, and took less than two hours total, to transfer ~$160,000 USD from an Electrum software wallet to a hardware wallet.

Get Your Ducks in a Row

If you’re looking to transfer a large sum of cash for any reason, whether to pay down a loan, or to invest in conventional or crypto markets, prepare well in advance. Get your ducks in a row by signing up for all required accounts, finish the Know Your Client (KYC) identity verification for every account, and make sure that your funds have moved and settled, at least a month in advance.

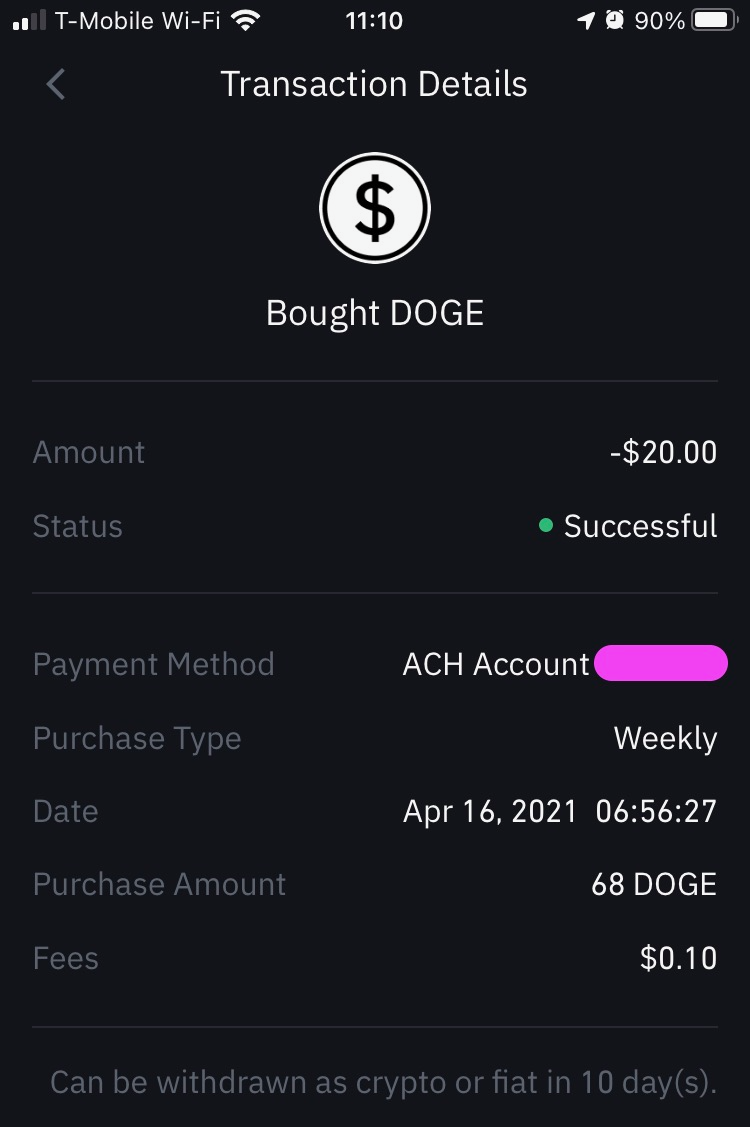

Exchanges like Coinbase and Binance.US impose a 10-day cooldown on coins purchased with ACH-deposited fiat before they can be transferred to another exchange or wallet. Keep this in mind when depositing fiat to execute arbitrage between exchanges, or if you plan on immediately transferring purchased coins to a hardware wallet.

Additionally, many exchanges have degraded service or full outages during high-volatility periods, and many times you’ve missed buying the dip due to the amount of time it takes funds to deposit and settle.

The One-Month Crypto Investment Timeline

Entire books can be written about what’s involved with setting up crypto accounts, but expect it to take about a month to sign up for crypto accounts, and to get funds deposited and settled before you’re able to make your first crypto purchase, trade, or investment.

- 2–10 days — Sign up for an account at all the crypto exchanges you think you might utilize, and immediately verify your identity. KYC identity verification will usually ask for photos of government-issued identification (such as driver’s license or passport), a selfie (sometimes holding a sheet of paper with the exchange’s name on it), social security number, and multiple-choice security questions.

- 2–10 days — Set up ACH transfers at all the banks and crypto exchanges you think you might utilize, and verify those accounts. When configuring an outbound ACH from a bank to a crypto exchange, the bank will usually deposit two small amounts, and ask you to verify that you successfully received those amounts.

- 2–14 days — Initiate ACH or wire transfers to fund your crypto exchange fiat account. These transfers may need to be manually approved by the bank.

It’s Hard (and Expensive) To Pay Off Loans Early

While not directly related to transferring cash to crypto exchanges, attempting to pay off loans early also exposes roadblocks to financial independence in the consumer banking system. While it’s been years since I was imposed a penalty for paying off a loan early, it can take weeks to transfer large sums of cash to a lender.

Even if you can afford to pay cash, conventional financial advice is to take out a loan to purchase a large asset, and to then invest your cash in something with a higher rate of return than the interest rate of the loan.

I bucked that usual financial advice last summer and, following the proverb of “a bird in the hand is worth two in the bush,” I decided to start paying down my mortgage and auto loan. The certainty of owning my home outright, contrasted by my high (by today’s standards) 4.125% mortgage interest rate, outweighed the potential growth of the crypto and stock markets. Investments are a gamble, but paying off debt is a sure thing.

So I initiated a $25,000 USD bill payment from Citizens Bank to Wells Fargo on the day of the month that I usually electronically pay my mortgage. After a few days, I received a message stating that my unusually-large electronic payment was delayed, and needed to be manually processed. A week later, my mortgage payment still hadn’t been processed, and the due date was fast approaching.

Begrudgingly, I initiated a second mortgage payment for $2,500 USD, which posted and applied to my mortgage within 24 hours. The initial $25,000 USD bill payment took another week to post, well after my due date, and I would have been imposed a late-payment fee had I not been carefully tracking my transfer.

And, when I finally pulled the trigger to pay off my auto loan in full, I had a similar wait for an ACH transfer to clear and settle.

My “Banking” Future

Once my mortgage is fully paid off, and I only have to worry about monthly incidentals, my end game is to abandon conventional checking and savings accounts altogether. My ideal financial workflow would be to have my payroll direct-deposited to a crypto exchange fiat wallet, diversify investments between various cryptocurrencies and conventional stocks and ETFs, and to utilize stock exchange cash sweep and crypto exchange fiat wallets in lieu of a checking account.

Crypto exchange staking-rewards debit cards could then be used in lieu of credit cards, only keeping enough coin and fiat on the exchange for incidentals, and then transferring all remaining crypto to hardware wallets or high-yield staking accounts.

Calculating capital gains tax becomes a no-brainer when utilizing services such as Cointracker.io that automatically track your entire crypto portfolio, including online exchanges, software wallets, and hardware wallets. The service even automatically differentiates income from receiving crypto payments, forks, and mining wallet deposits from gains/losses from trading and arbitrage.

Unfortunately, a conventional checking account would still be required to stage 1099-MISC payments, and to pay bills for vendors that don’t accept credit/debit cards or ACH transfers, but it’s only a matter of time before crypto exchanges start offering bill pay and mobile check deposit.

1 thought on “Attempting to Transfer Cash From My Checking Account to a Crypto Exchange Only Increased My Dislike of Banks, and Reinforced My Support For Cryptocurrencies Like Bitcoin”

Comments are closed.